Cass County residents have among lowest credit card debt

By Raymore Journal staff

It may be hard for some Raymore residents to believe given the current economic climate, but Cass County has some of the lowest credit card debt in Missouri.

Results of a new study published by online financial advising firm SmartAsset has Cass County ranked among the top 10 Missouri counties with the lowest credit card debt per capita. By analyzing credit card debt as a percentage of both income and wealth, the data found the following counties have the lowest credit card debt index:

- Osage

- Perry

- Miller

- Lafayette

- Benton

- Genevieve

- Cooper

- Louis

- Ray

- Cass

These counties have something else in common. A map color-coding every county’s credit card debt index reveals a correlation with low credit card debt and counties along the Interstate 70 corridor. As counties get further north or south of I-70, the credit card debt index trends upward.

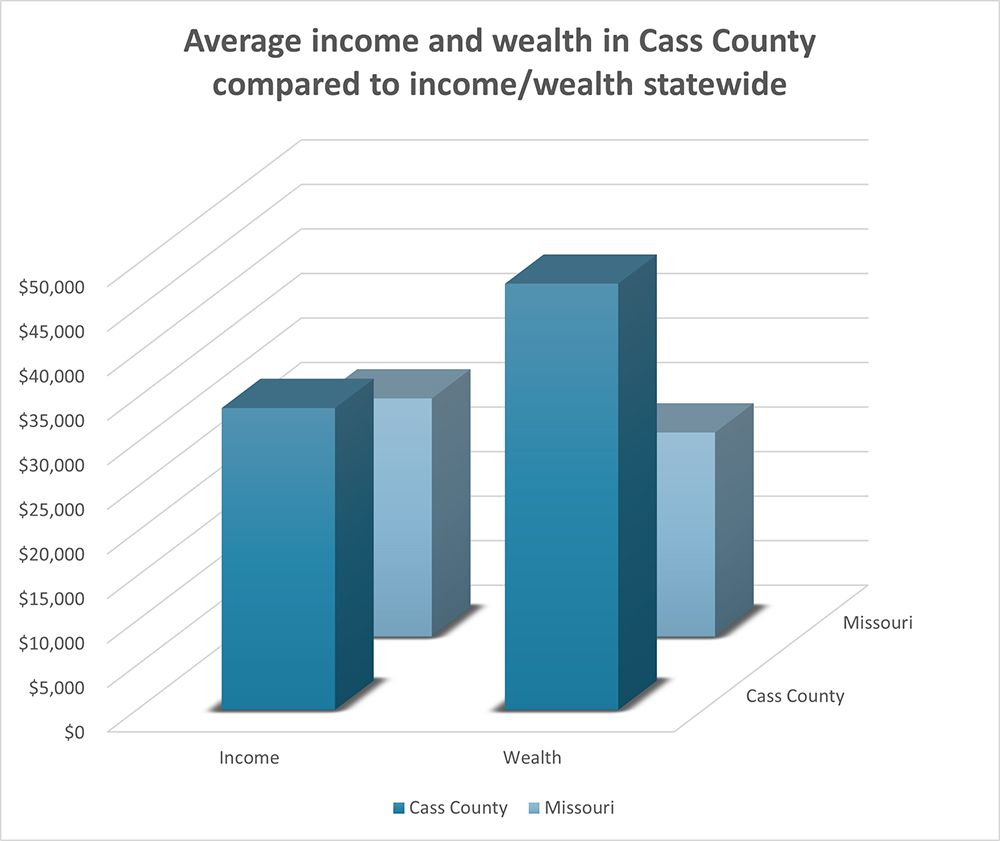

Accounting for only credit card debt as a percentage of income, Cass County’s ranking plummets to 26. Cass County’s debt/income percentage is 8.1%. For comparison, No. 1-ranked Miller County’s credit card debt is only 5.6% of income, on average. The state average is 8.7%.

However, Cass County has the second-lowest debt as a percentage of wealth at 5.7%, with only Osage County (5.6%) with a lower rate. The state average is 12.2%.

Missouri’s wealth gap

According to SmartAsset, debt as a percentage of income can serve as a benchmark to determine whether people will be able to pay off that debt. Conversely, debt-to-wealth numbers may be indicative of overall financial stability.

With few exceptions, counties with some of the lowest credit card debt indexes have more wealth compared to their respective income, including Cass County. However, the data also reveals that the average Missourian’s wealth is lower than their income, suggesting the average Missourian cannot afford certain assets.

A variety of factors can lead to one’s wealth being valued less than their income. Someone saddled with student loan debt is likely to be less wealthy than someone with the same income and no student loan debt. Conversely, someone receiving an inheritance will likely have much more wealth compared to someone with the same income.

Data from the Center on Budget and Policy Priorities, a nonpartisan research and policy institute, highlight that difference at the national level. In 2016, nearly a quarter of the nation’s before-tax income went to the top 1%, with the bottom 90% accounting for half of all income. However, the bottom 90% of Americans own less than a quarter of the nation’s wealth, revealing a higher concentration of wealth at the top.

Even if Americans are earning more than previous decades and generations, their ability to build wealth has been diminishing compared to those in the top 10%.

Circling back to SmartAsset’s study, the data shows a similar income and wealth distribution gap among Missouri counties. There is much less disparity among average debt-to-income rates as there is with debt-to-wealth rates.

At the state level, Cass County’s numbers suggest its residents’ financial situation is more reminiscent of the top 10% of Americans than the bottom 90%. The study does not include data that may indicate what factors contribute to the county’s income and wealth numbers.